Everyone has a dream to have his Dream House. He wants to have his own house that provides shelter for a lifetime. But having own house at this time is very difficult to buy for a layman. Prices are getting high of properties tremendously. In this article, you are getting to know about financial management that will guide you for an investment of your money for a long time.

|

| dreams come real with PPF investment scheme |

Let's you are 20 years of age. You have a dream to have your house in your 35s and your earning is around 15-20k right now. So how you should invest in PPF:

PPF viz Public Provident Fund is a saving cum Investment scheme ensured by the government of India for small saving purposes. PPF is a fully secured investment scheme that is tax exempted. You can invest in this scheme for tax savings as well. PPF can give you huge returns over a long period. It is extendable with deposit and non-deposit options for further 5 years blocks for unlimited times. A most interesting fact is that as you show your properties like assets to get a loan from a bank, you can show your PPF account against getting a loan from the bank.

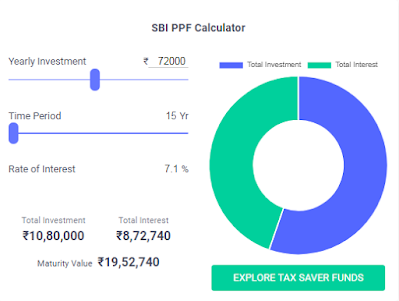

PPF works in compound interest, which means you get interest on interest. This boosts your money in late of investing money. Currently, the interest rate of PPF is 7.1%, before it was around 7.9% this reduced because of COVID-19 (the Corona Virus Disease 2019).

Now, look at the miracle of the PPF investment plan. If you save only 6000/- from your salary per month and invest in PPF, it is 72,000/- annually investment.

|

| PPF Calculator: Source - Grow Application |

You can get around 20 lakh INR in just an investment of 6k per month for 15 years. You can also extend this investment for 5 years in a block for unlimited times after its maturity. Because of compounding interest, your money gets an exponential hike. Now you can buy your dream house.

Note: buying a house in big cities, in an expensive area is based on temporary emotions. Never buy property in big cities taking a loan from banks, if your salary/source of income is not justifying to the property. In the next 15 years, 20 lakh would not be that impressive amount, but there must be some areas where you will be able to buy a decent home. You can plan to build your own home on your property.

Hope this article is beneficial for you. You can visit our YouTube Channel "Digital Soft Hub" for more updates.

Thanks!

No comments:

Post a Comment